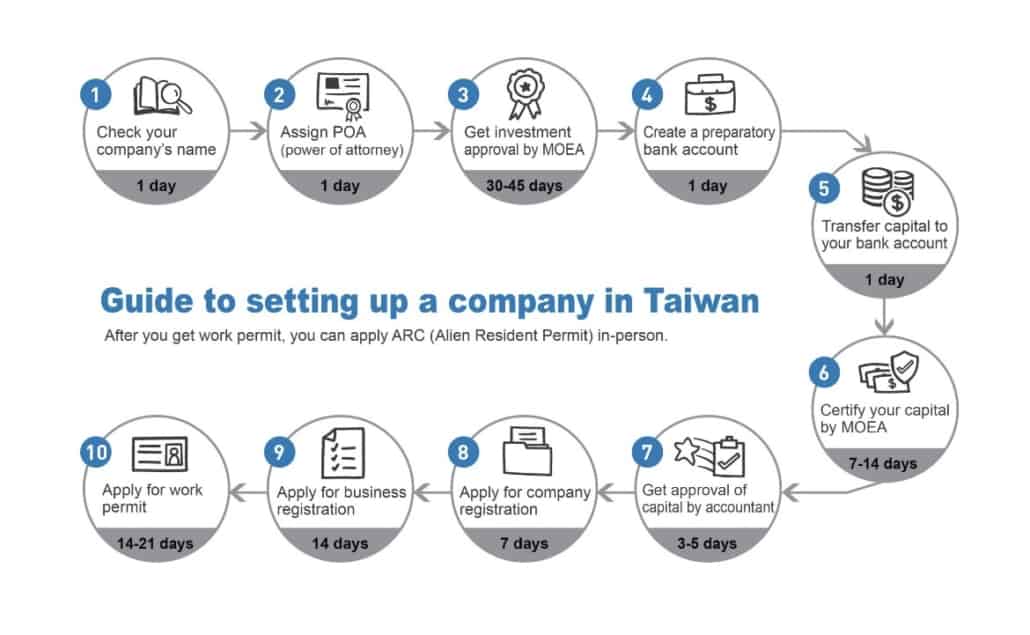

how to register company in taiwan

Before register company in Taiwan, the foreigner must fill out and submit the “Application Form for Initial Investment (Including Company Establishment) of Foreigners” for review by the Investment Review Committee, Ministry of Economic Affairs. Upon approval by the IRC, the und can be transferred to Taiwan for the company registration procedure. It generally takes a month for foreigners to establish a standalone company. Since branch companies and representative offices are managed by the Department of Commerce, Ministry of Economic Affairs, the process is more straightforward and can be completed faster.

內容目錄

1. Company name pre-check

To start a company in Taiwan, you first need to reach the Ministry of Economic Affairs to pre-check the company name you choose and determine your scope of business. Since there is a chance that the name you have in mind is taken, you are advised to submit at least 3 to 5 names ranked by your preference.

Time required: 1-2 days

2. Power of attorney

Investors not residing in Taiwan or linguistically challenged may assign others the power of attorney (POA) to embark on procedures like company establishment, investment review, and fund approval. This process must be notarized and accompanied by a POA document.

Time required: 1-2 days

3. Investment review

The most crucial hurdle to overcome for foreigners to invest and open a company in Taiwan is the review by the Investment Review Committee, Ministry of Economic Affairs. This procedure aims to examine the source of foreign capital and the scope of business. Branch companies and representative offices, on the other hand, are managed by the Department of Commerce, Ministry of Economic Affairs.

Time required: 30-45 days

4. Opening a preparatory bank account

Upon approval by the Investment Review Committee, the investor may open a preparatory bank account at a local bank. The investor must show up in person with all the required documents at the bank to complete the procedure. The fund must be wired to that local bank account in a foreign currency in a single transaction and simultaneously exchanged into New Taiwan Dollars. The amount in NTD must be the exact number stated on the investment application.

Time required: 3-5 hours

5. Capital verification

Once the fund is deposited, the capital will be verified by the Investment Review Committee.

Time required: 7-14 days

6. Capital audit

Once the Investment Review Committee verifies the capital, we may proceed to the company establishment. The first step is to have a certified accountant verify the registered capital and prepare a “Capital Verification Report”.

Time required: 3-5 days

7. Company registration

Once the “Capital Verification Report” is ready, the investor may present it along with other documents to the local county/city government to conduct company registration. For places like Taipei City, the registration can be processed on-site. If that is the case, the investor can obtain the “Unified Business Number” on the same day.

Time required: 1-2 hours

8. Taxation registration

Upon completing the company registration, you may proceed to taxation registration with National Taxation Bureau. After receiving the confirmation letter, you may use that and the invoice stamp to purchase the “Invoice Purchase Certificate” from National Taxation Bureau, which will formally enable your company to engage in business transactions.

Time required: 7-14 days

9. Work permit for managers

If an investor wishes to reside in Taiwan to run their company, he/she may apply for a work permit as a foreign manager. That permit will later enable the investor to apply for Alien Residence Certificate (ARC) with National Immigration Agency.

Time required: 7 to 14 days